Trusted by traders worldwide

Delivering adaptive rotating quantitative systems for traders and firms

Delivering adaptive rotating quantitative systems for traders and firms

We are a boutique trading firm that develops robust, custom algorithmic portfolios designed for long-term performance and resilience. Each strategy is part of a dynamic system. Continuously monitored, updated, and rotated to adapt to evolving market conditions.

We are a boutique trading firm that develops robust, custom algorithmic portfolios designed for long-term performance and resilience.

OUR SOLUTION

We build rotating

algorithmic portfolios

We specialize in providing automated trading algorithms designed to execute tailored investment strategies across a diverse range of markets, including commodities and index futures.

Each model is built for robustness and adaptability, ensuring consistent performance and reliable execution across changing market conditions.

- Commodities

- S&P500 futures

- Nasdaq futures

OUR SOLUTION

We build rotating

algorithmic portfolios

We specialize in providing automated trading algorithms designed to execute tailored investment strategies across a diverse range of markets, including commodities and index futures.

Our custom algorithmic portfolios are built to maximize long-term returns while carefully managing risk. We continuously monitor and update these systems to adapt to changing market conditions. This ensures that only the most effective strategies are active, and underperforming ones are rotated out.

We specialize in providing automated trading algorithms designed to execute tailored investment strategies across a diverse range of markets, including commodities and index futures.

- Commodities futures

- Indices futures

100+

Algorithms created and validated

15+

years of market data per model

200+

worldwide traders and firms trusted us

100%

documented & auditable

100+

Algorithms created and validated

15+

years of market data per model

200+

worldwide traders and firms trusted us

100%

documented & auditable

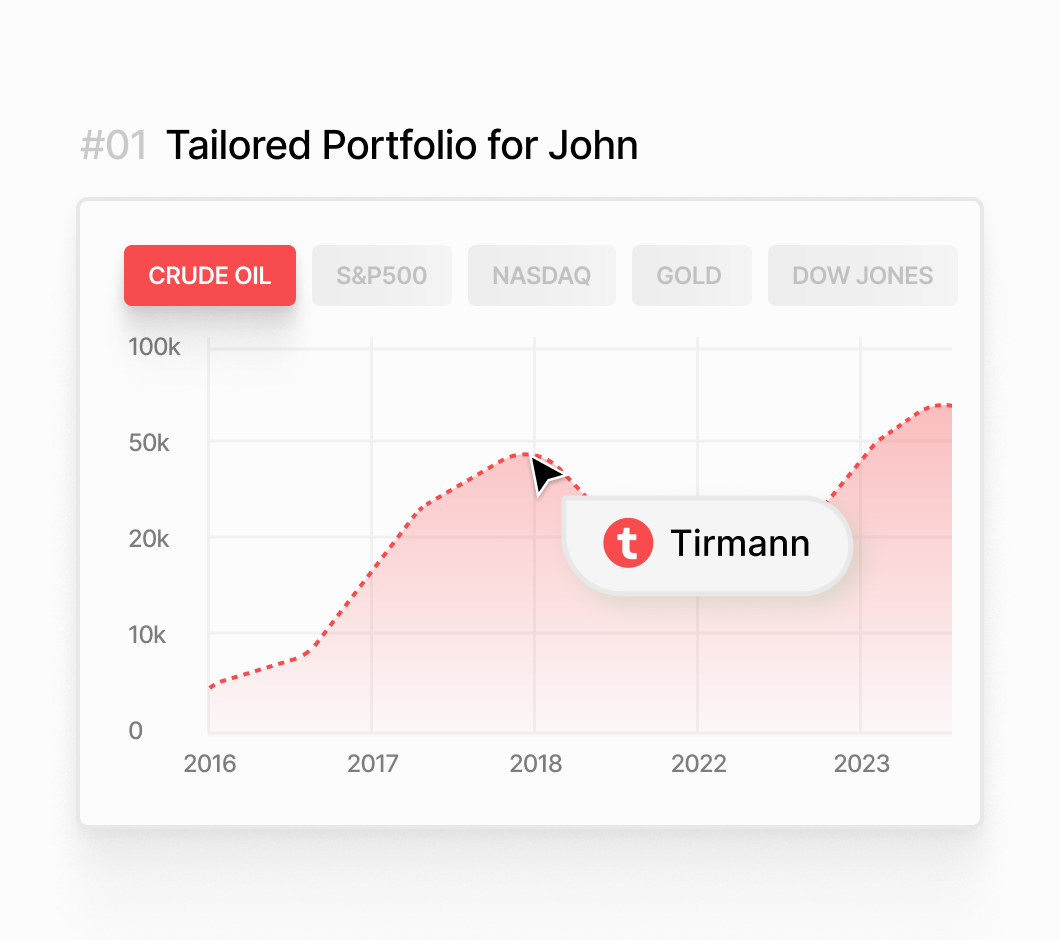

WHAT WE OFFER

Maximize your capital with

tailored algorithmic strategies

Expert support to design and deploy custom algorithmic portfolios, tailored to each client’s capital, risk, and objectives. Built from rigorously validated strategies, monitored continuously, and designed for simplicity, diversification, and long-term resilience.

Expert support in designing and deploying a custom algorithmic portfolio tailored to each client’s capital, risk profile, and specific objectives.

Initial consultation

Personalized session to map out your objectives and risk preferences.

Portfolio design and review

Portfolio built around your capital and goals, followed by a full review and Q&A.

Strategy and portfolio report

Full documentation of selected strategies, logic, backtests, and allocation.

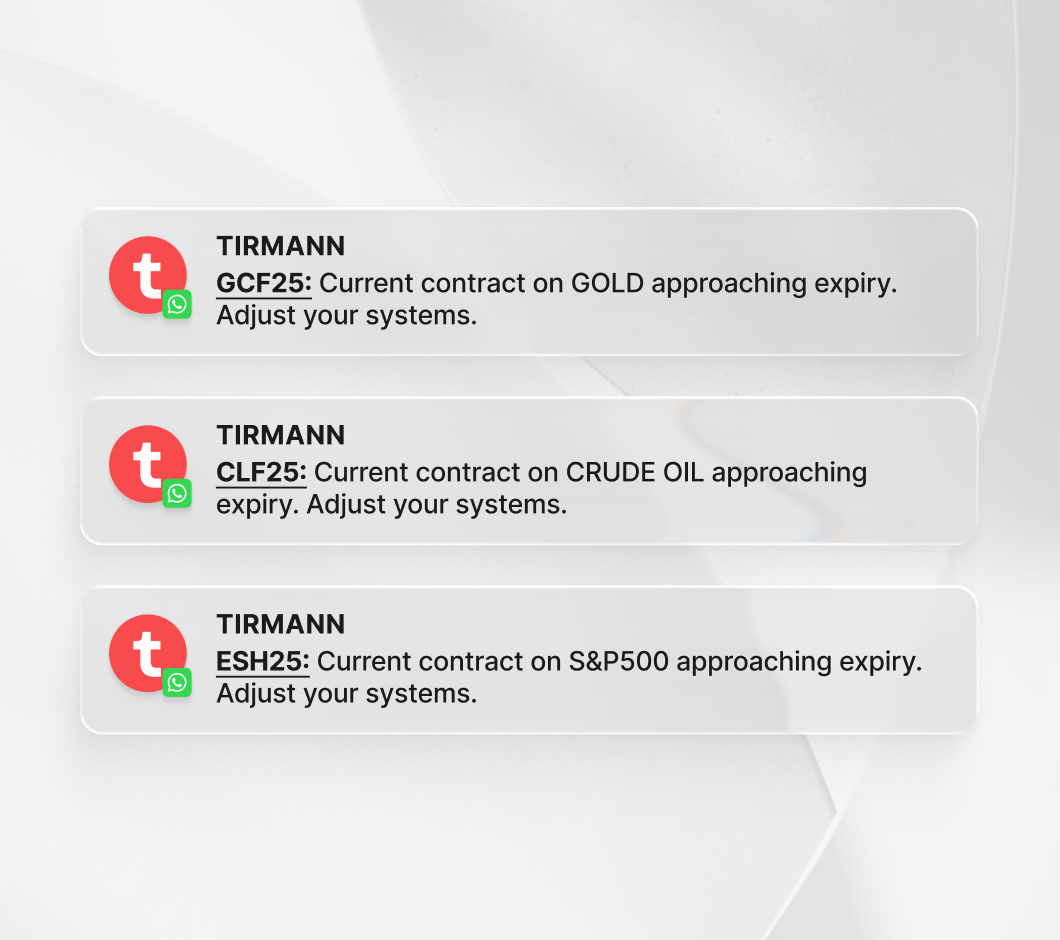

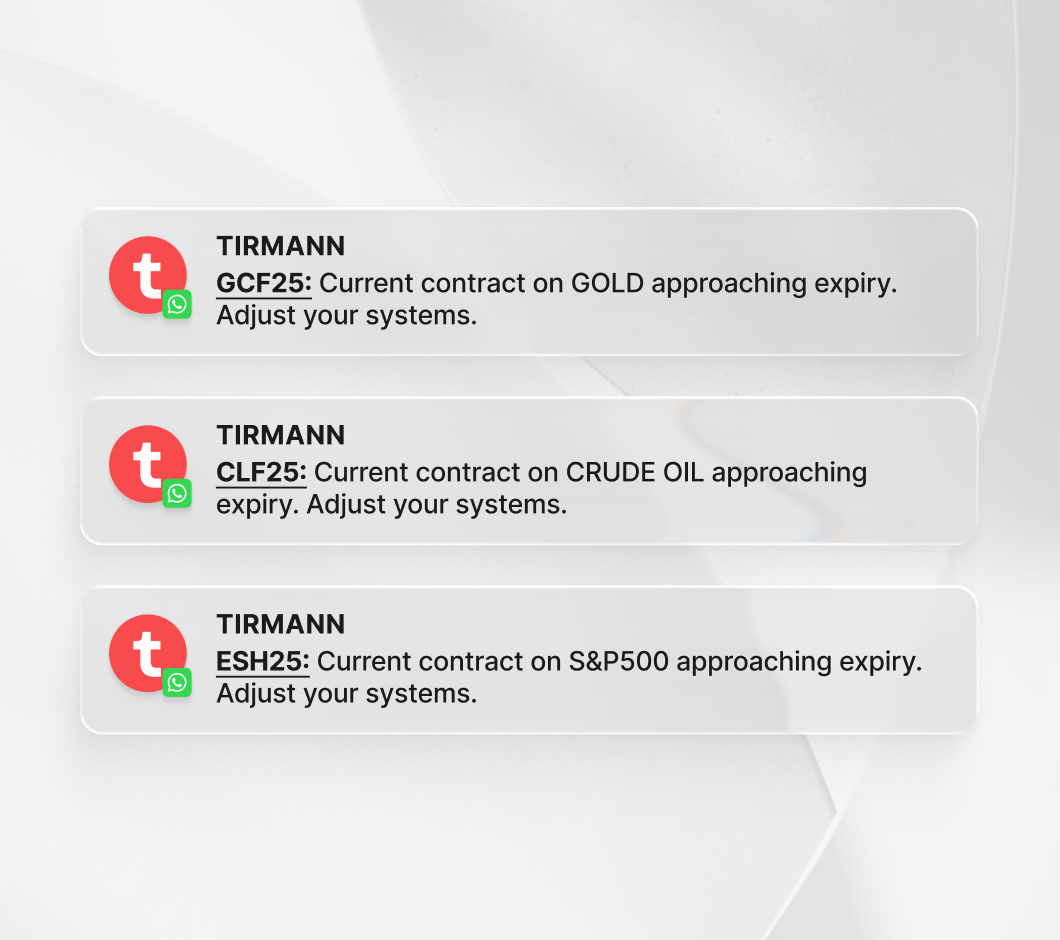

Futures rollover alerts

Alerts to help you manage contract rollovers and maintain uninterrupted execution.

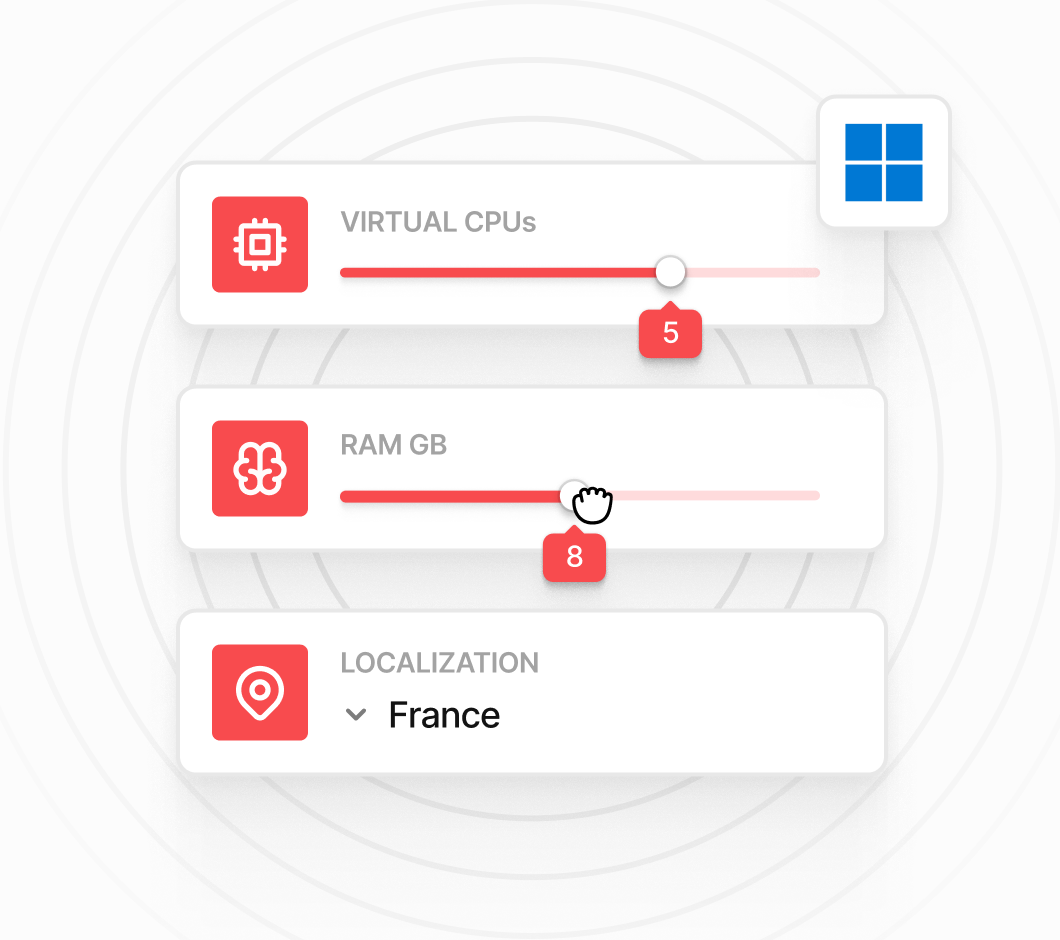

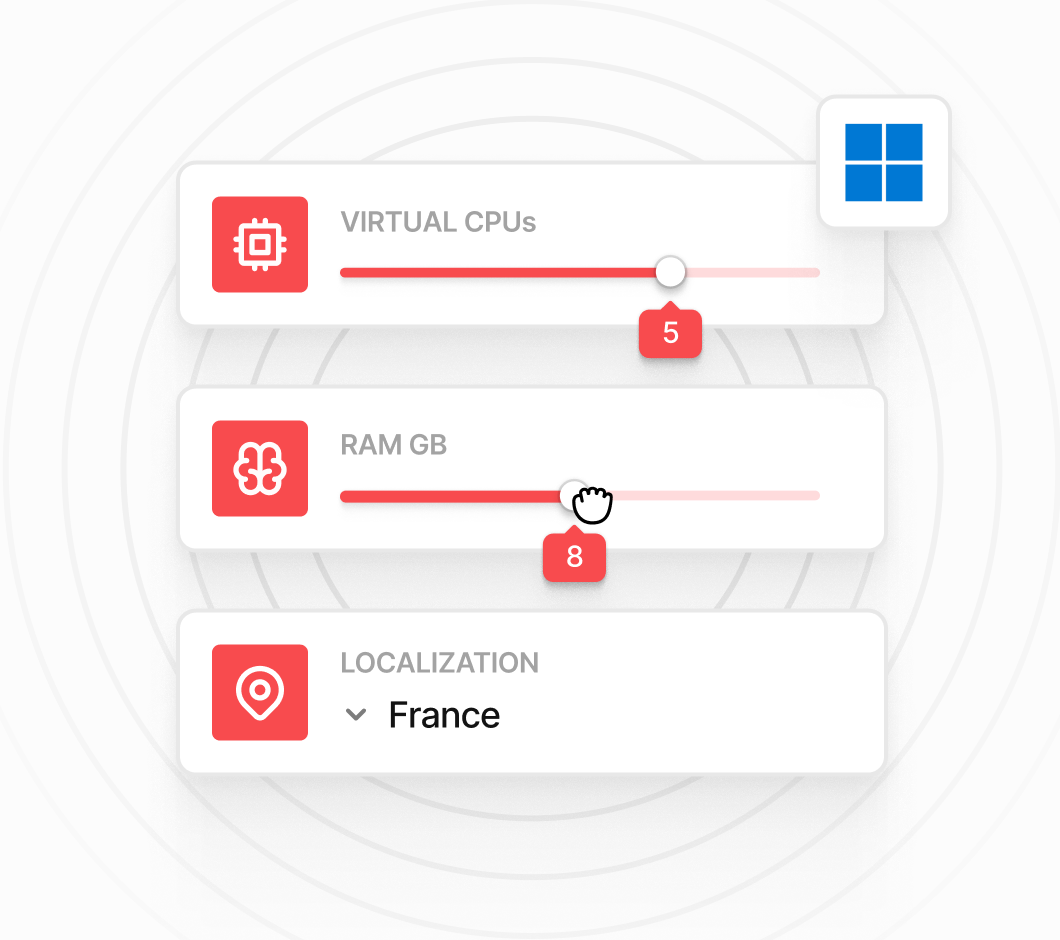

VPS Setup

Management hub

Onboarding covering platform operations including rollovers, algorithm management to maximize autonomy.

Strategies rotation

Monthly updates to your portfolio based on live performance, capital allocation, and market conditions. Underperforming strategies are reviewed and rotated out in favor of more effective systems, ensuring continuous optimization and alignment with your objectives.

WHAT WE OFFER

Maximize your capital with tailored algorithmic strategies

Expert support in designing and deploying a custom algorithmic portfolio tailored to each

client’s capital, risk profile and specific objectives.

Initial consultation

Personalized session to map out your objectives and risk preferences.

Portfolio design and review

Portfolio built around your capital and goals, followed by a full review and Q&A.

Strategy and portfolio report

Full documentation of selected strategies, logic, backtests, and allocation.

Futures rollover alerts

Alerts to help you manage contract rollovers and maintain uninterrupted execution.

VPS Setup

Management hub

Onboarding covering platform operations including rollovers, algorithm management to maximize autonomy.

Strategies rotation

Underperforming strategies are reviewed and rotated out in favor of more effective systems, ensuring continuous optimization and alignment with your objectives.

WHAT WE OFFER

Behind the strategies

Our approach combines rigorous strategy design, diversified portfolio construction, and adaptive monthly rotation. The goal: a transparent and disciplined framework that stays aligned with market cycles and delivers long-term resilience.

Our approach combines rigorous strategy design, diversified portfolio construction, and adaptive monthly rotation.

PROCESS

The roadmap to your custom portfolio

We work closely with you to understand your objectives and risk tolerance. From there, we design and test a personalized strategy that meets your needs.

We work closely with you to understand your objectives and risk tolerance. From there, we design and test a personalized strategy that meets your needs.

Consultation and profile analysis

This step lays the foundation for a portfolio truly aligned with your specific needs.

Custom portfolio design

Each portfolio is uniquely tailored to your profile, built on principles of strategic complementarity and cross-strategy decorrelation.

Validation and delivery of the strategy report

Full transparency before deployment. You receive a comprehensive prospectus detailing long-term backtests, key metrics, strategic rationale, stress tests, and more.

Setup and technical onboarding

We support you through the entire setup process: Multicharts configuration, VPS installation if needed, and functional verification.

Algorithm monitoring and rotation

Ongoing performance tracking, rollover notifications, and monthly updates ensure your portfolio stays optimized and aligned with market dynamics.

OUR APPROACH

Data-driven strategies development

for real-world execution

Institutional-grade backtesting over 15+ years

Each model is validated across multiple market regimes and volatility cycles.

Fully documented and auditable systems

No black-box logic, all strategies are delivered with structured documentation.

Dedicated professional technical support 7/7

Direct access to engineering support for deployment, monitoring and related queries.

Transparent pricing, no recurring hidden costs

A one-time setup fee model. No profit-sharing, no rebills, no subscription traps.

Dynamic monthly strategies rotations

Portfolios are monitored to replace weak models and add new validated ones.

Turnkey infrastructure with dedicated VPS

We deliver a stable, scalable environment for smooth deployment.

Detailed strategy and portfolio blueprints

You receives structured PDF reports detailing logic, risk historical performance.

Model selection based on cross-strategy synergy

Each algorithm is integrated based on how it interacts with the full portfolio, not in isolation.

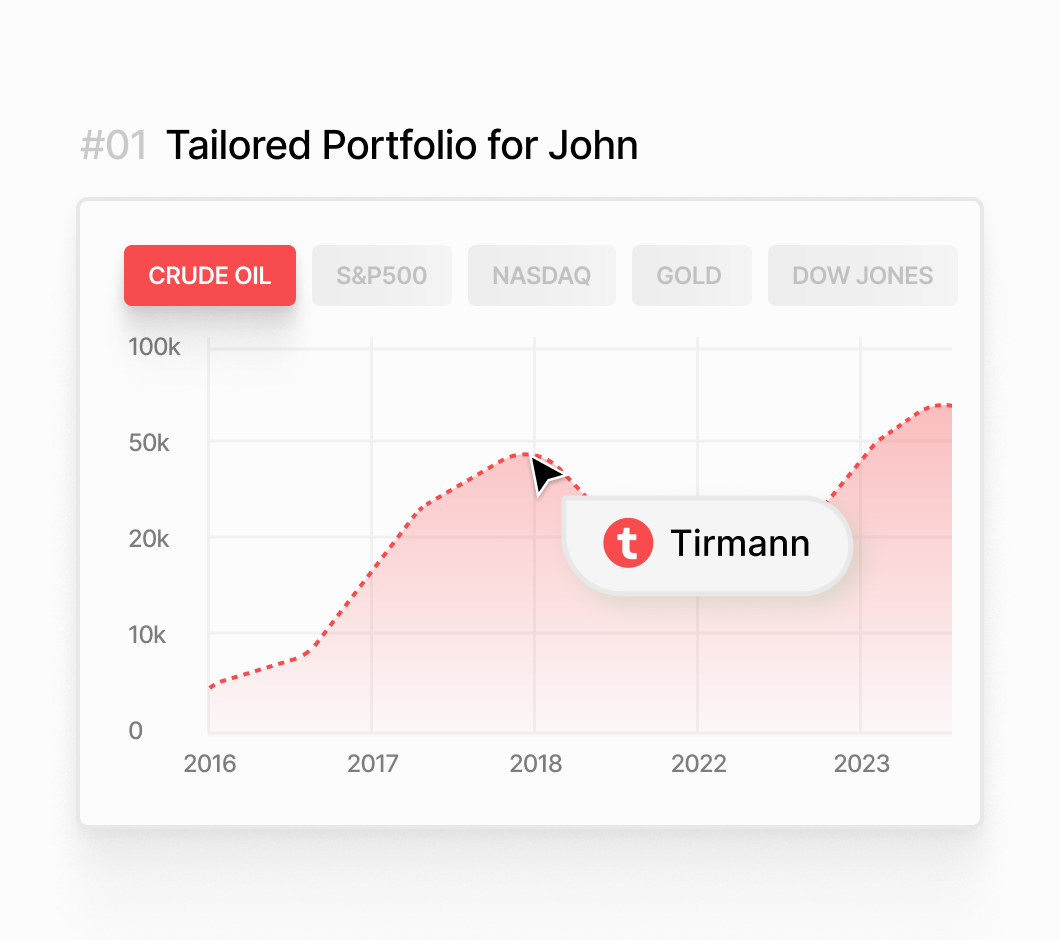

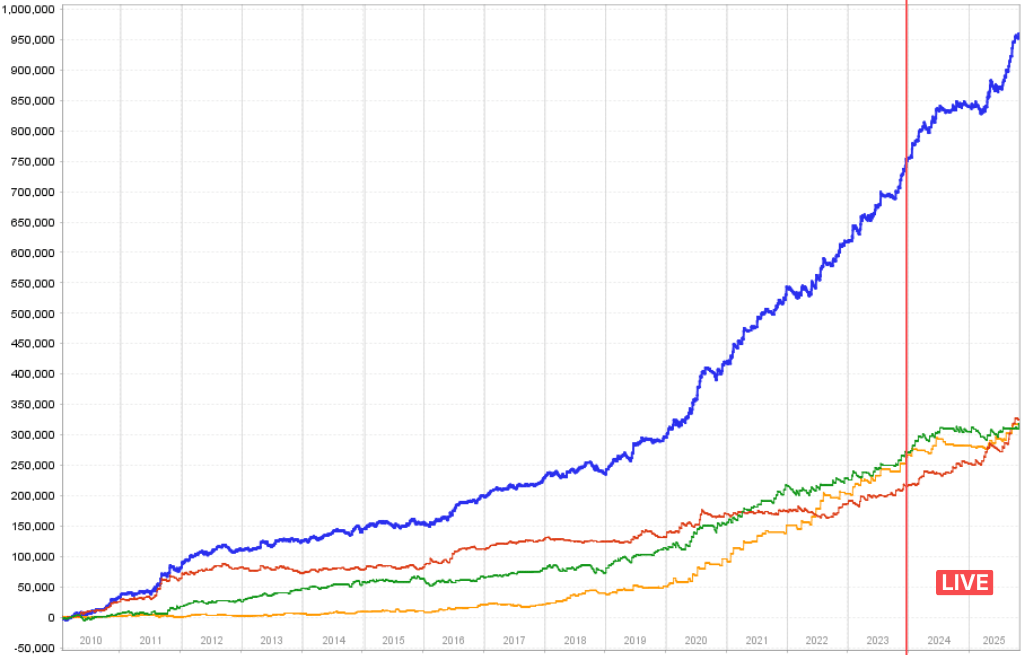

OUR WORK

From portfolio design

to live execution

Explore sample portfolios built from validated strategies, diversified across markets and risk profiles.

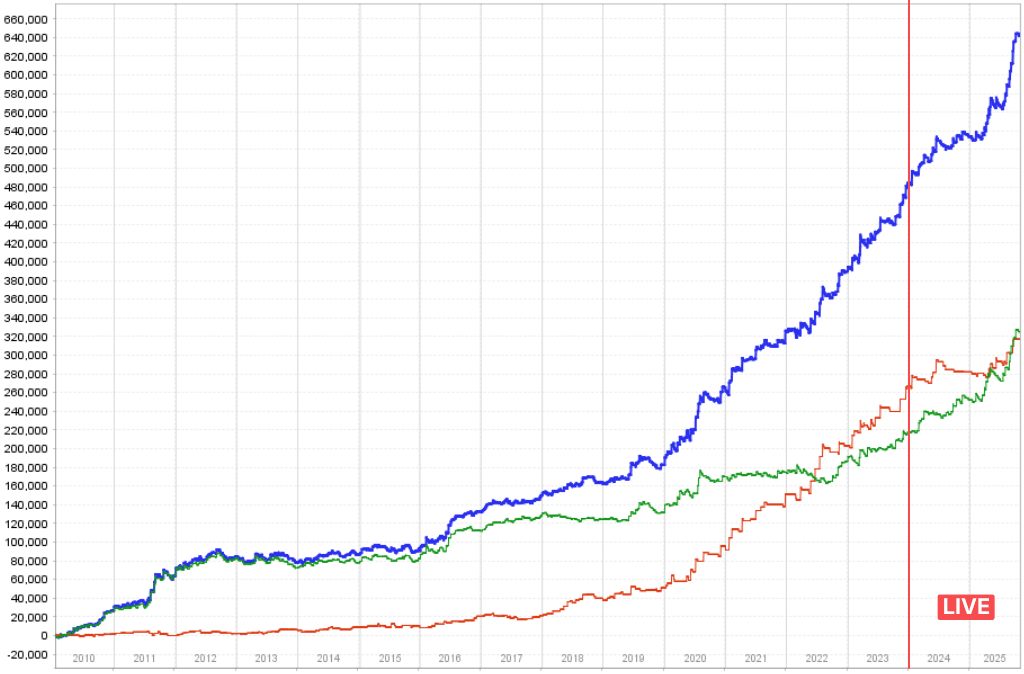

Explore sample portfolios built from validated strategies, diversified across markets and risk profiles. Each allocation illustrates how rotation and synergy create consistency, adaptability, and disciplined performance over time.

These portfolios are provided as illustrative examples only. Final allocations are fully customized based on each client’s objectives, capital, and risk profile.

- Nasdaq futures + Gold futures

- Net profit : 668 277.5$

- Drawdown : (17 600$)

- Return on max portfolio drawdown : 36.49

- Development period : 01.01.2010 - 31.12.2023

- Last 8 months performance : 108 755.00$

- Synergy ratio (must be < 1) : 0.918580

- Risk reduction through portfolio diversification : 8.14%

These portfolios are provided as illustrative examples only. Final allocations are fully customized based on each client’s objectives, capital, and risk profile.

- Nasdaq futures + Gold futures + S&P500 futures

- Net profit : 958 697.5$

- Drawdown : (20 330$)

- Return on max portfolio drawdown : 47.16

- Development period : 01.01.2010 - 31.12.2023

- Last 8 months performance : 121 556.00$

- Synergy ratio (must be < 1) : 0.903054

- Risk reduction through portfolio diversification : 9.69%

OUR EDGE

How we stands apart

Not all trading solutions are created equal. While most retail providers focus on selling isolated strategies with limited longevity and support, Tirmann offers a robust, institutional-grade framework built for performance, transparency, and adaptability.

Tirmann offers a robust, institutional-grade framework built for performance, transparency, and adaptability.

Strategy & methodology

Retail-focused providers

Service & support

Transparency & reliability

More questions ?

out to us.

Retail providers

WHAT OUR PARTNERS SAYS

Voices from the journey

Discover how independent traders, portfolio managers, and allocators apply Tirmann’s systematic framework to build robust, adaptive strategies. They’re real-world insights from professionals using our methodology to navigate today’s markets with precision and confidence.

Charly

What sets Tirmann apart is the engineering discipline and the transparency. I wasn’t looking for a plug-and-play miracle. I wanted a framework I could trust. From the initial portfolio consultation to the delivery of a fully documented system, everything was rigorous and grounded in measurable performance. I particularly value the rotation process, which keeps my portfolio responsive without relying on my constant intervention. It’s a serious operation, run by people who clearly trade their own models.

Louis

Before working with Tirmann, I had never considered algorithmic trading as a serious or accessible path. Like many, I assumed it was reserved for quants at hedge funds or required advanced coding skills. Discovering their boutique approach completely changed my perspective. The onboarding was structured, the explanations were clear, and I was guided step by step through the logic and execution of each strategy. I quickly realized how much work had gone into making this ecosystem both robust and accessible.

Max

As someone who’s spent years in research, I’m extremely cautious about anything marketed as ‘automated trading’. What I found with Tirmann was different: well-defined strategies, clean implementation, robust validation, and a process-driven portfolio framework. The systems are backed by 15+ years of historical data and real stress-testing. Most importantly, the documentation allows for reproducibility and full due diligence which is essential for any serious investor.

Julian

I have spent years trying to build a stable basket of futures strategies. Tirmann’s offering immediately stood out due to their real out-of-sample validation and walk-forward optimization, not just curve-fitting. The strategies adapt well to different market regimes, and the portfolio rotation process is genuinely data-driven. I especially appreciate that I can keep running my own infrastructure with their models, without being locked into a proprietary ecosystem.

Thomas

I’ve reviewed countless algorithmic offerings in my career, but few match Tirmann’s level of structure and risk-awareness. Their rotation model based on objective rules and performance thresholds is exactly what most retail and semi-pro traders overlook. The systems themselves are robust, but what really adds value is the lifecycle management. Nothing is left to chance.

Danny

Most people don’t realize that even good strategies stop working. Tirmann’s approach addresses that head-on. Their monthly performance reviews and strategy rotations allow me to avoid long drawdowns and maintain a high level of portfolio efficiency over time. There’s a clear process behind each decision, and I always feel like the system is evolving with me. The recurring updates give me confidence that what I’m trading is still relevant.

BOOK A FREE DISCOVERY CALL

From first call to live trading

From the initial consultation to full deployment, we guide you through a clear, structured process. Every portfolio is tailored to your goals, capital, and risk profile.

From the initial consultation to full deployment, we guide you through a clear, structured process.

Tom

Tirmann’s rotation framework transformed my trading. The portfolio adapts every month to the strongest strategies, and the continuous support keeps everything running flawlessly. My performance is smoother with far less stagnation. While the continuous guidance !

BOOK A FREE DISCOVERY CALL

From first call to live trading

From the initial consultation to full deployment, we guide you through a clear, structured process. Every portfolio is tailored to your goals, capital, and risk profile.

From the initial consultation to full deployment, we guide you through a clear, structured process.

FREQUENTLY ASKED QUESTIONS

Clarity before commitment

We believe informed decisions lead to better outcomes. This section addresses the most common questions about our process, tools, and philosophy. So you can move forward with full confidence.

We believe informed decisions lead to better outcomes. This section addresses the most

common questions about our process,

tools, and philosophy.

What exactly is included ?

Tailored strategy selection, robust portfolios, automated monthly rotation, operational monitoring, turnkey VPS hosting, and concise guidance.

Why not just buy an algo online ?

Because strategies have a limited shelf life. Buying a static algo is a blind bet. With Tirmann, you get a living, evolving system based on dynamic rotation and rigorous monitoring. An infrastructure that delivers true edge.

Why delegate instead of building myself ?

Building yourself costs time, money, and exposes you to costly errors and biases. Tirmann saves you time, delivers discipline, and robust expertise baked in from day one.

Do you manage my money ?

No. You retain full control. We design and support the algorithmic architecture, not your capital.

I’m new to systematic trading. Is this for me ?

Yes, if you are serious and ready for a disciplined, rigorous approach. Our support adapts to all levels.

Is it complicated to use ?

Not at all. The onboarding is intuitive, supported by dedicated guidance. You only handle essential operations like rollovers and updates.

What capital is needed ?

The minimum capital required is $20,000. This threshold ensures that our users can achieve meaningful profitability while fully benefiting from the quality and scope of our services.

Why do you use MultiCharts ?

MultiCharts is the industry standard for professional algorithmic trading. It delivers unmatched stability, execution speed, native data management, and rigorous backtesting capabilities. Python and TradingView are valuable tools but don’t yet offer the robustness required for institutional-grade portfolio management.

Do I need to learn PowerLanguage ?

No. Everything is pre-coded, tested, and optimized by our team. Your role is to manage and monitor your portfolio. Not to develop code.

Do I need to purchase a MultiCharts license ?

Yes, you must acquire a MultiCharts license. Either a lifetime license or a subscription. This is an essential investment that pays for itself quickly through the stability and performance gains it enables. While we can sometimes help you access preferential pricing, Tirmann is fully independent and not affiliated with MultiCharts in any way.

Do you guarantee performance ?

No. All investments carry risk. We build on rational, tested foundations but make no promises about future returns.

How do you select strategies ?

Every strategy undergoes exhaustive testing: 15+ years of backtests, walk-forward optimization, out-of-sample validation, and Monte Carlo stress tests. No strategy is included without proven robustness.

What is the monthly rotation ?

A strict, rule-based process to remove underperforming strategies and adapt the portfolio dynamically to current market regimes.

Am I left on my own after setup ?

Never. Continuous expert support and monthly updates are included to ensure ongoing success.

How often are updates ?

Monthly. You receive a detailed Portfolio Blueprint report and portfolio adjustments based on clear metrics.

What is the lifespan of a strategy ?

Limited. Markets evolve constantly. Continuous monitoring, adjustment, and replacement are essential to sustained performance.